Introduction to Biometric Payment Technology

The world of payments is evolving at lightning speed, and one of the most exciting advancements is biometric payment technology. Gone are the days when we relied solely on cash or plastic cards to make transactions. With biometrics, our unique physical traits—like fingerprints, facial recognition, or even iris scans—become keys to secure payment systems. This innovative approach not only enhances convenience but also ramps up security measures in an age where fraud and identity theft are rampant.

Imagine walking into a store, grabbing your items, and simply paying with a smile or a touch of your finger. That’s the future that biometric payment technology promises. It’s more than just a trend; it represents a significant shift in how we think about money and personal security. As this technology continues to develop across various sectors, its implications for consumers and businesses alike are profound. Let’s dive deeper into what makes this technology so transformative!

How Does It Work?

Biometric payment technology relies on unique biological traits to verify identity. This could include fingerprints, facial recognition, or even voice patterns.

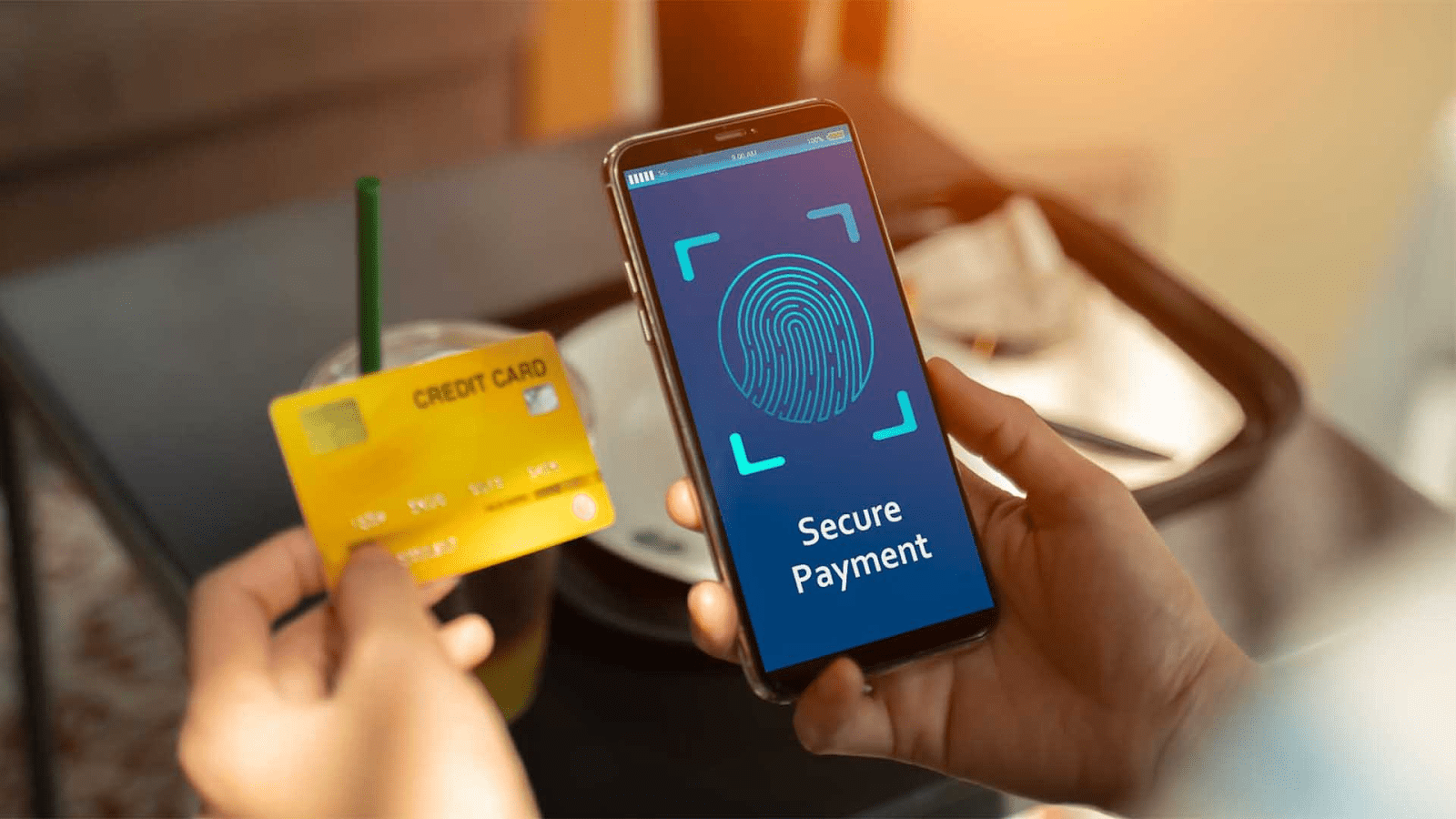

When a user initiates a payment, the device scans their biometric data and compares it against stored information. If there’s a match, the transaction proceeds seamlessly.

The entire process usually takes just seconds. It’s designed for convenience while ensuring security.

Devices equipped with biometric sensors capture the necessary data during transactions. These systems often use advanced algorithms to analyze and authenticate quickly.

This method reduces reliance on passwords or PINs that can be forgotten or hacked. Instead, your body becomes your password—something you always have with you.

As this technology evolves, it continues to integrate into various platforms—from smartphones to point-of-sale systems in stores—making payments smoother than ever before.

Benefits of Biometric Payment Technology

Biometric payment technology offers numerous advantages that stand out in today’s digital landscape. One of the most significant benefits is enhanced security. By relying on unique biological traits, such as fingerprints or facial recognition, transactions become nearly impossible to forge.

Convenience plays a crucial role too. Users can complete purchases without fumbling for cards or remembering passwords. A simple scan is all it takes.

Speed is another compelling factor. Biometric systems streamline the checkout process, allowing customers to finish transactions within seconds. This efficiency enhances customer satisfaction and encourages repeat business.

Moreover, this technology reduces fraud risks significantly. As biometric identifiers are hard to replicate, businesses enjoy lower chargeback rates and improved trust among consumers.

Adopting biometric payments fosters innovation in retail experiences, paving the way for future advancements in how we conduct financial exchanges.

Security and Privacy Concerns

Biometric payment technology offers convenience, but it also raises significant security and privacy concerns. Users must understand that their biometric data—like fingerprints or facial recognition—is unique and cannot be changed if compromised.

Data breaches are a real threat. Cybercriminals could potentially hack databases storing biometric information, leading to identity theft on an unprecedented scale. Unlike passwords, which can be reset, stolen biometrics offer long-term access to sensitive accounts.

Additionally, the collection of biometric data often involves tracking users’ movements and habits. Such surveillance can infringe upon personal privacy rights. Many individuals remain wary about how their information is stored, used, or shared by companies.

Furthermore, regulations surrounding biometric data protection vary widely across regions. This inconsistency creates challenges for businesses aiming to comply while ensuring user safety in this rapidly evolving landscape of payment technology.

Current Use and Development in Different Industries

Biometric payment technology is gaining traction across various industries. Retailers are implementing fingerprint and facial recognition systems at checkout counters, streamlining the purchasing process for customers.

In healthcare, biometric payments enhance patient experiences. Patients can settle bills using their fingerprints or iris scans, reducing wait times and improving accuracy in transactions.

The hospitality sector is also embracing this innovation. Hotels now offer keyless entry through biometrics. Guests can check in and access their rooms without physical keys, providing an added layer of convenience.

Moreover, financial institutions are experimenting with voice recognition for online banking transactions. This not only speeds up processes but also enhances security measures against fraud.

With ongoing advancements, more sectors are likely to adopt biometric solutions to improve customer experience while ensuring secure payments.

Comparison with Traditional Payment Methods

Traditional payment methods, like cash and credit cards, have served us well for decades. Yet, they come with certain limitations. For example, carrying cash can be cumbersome while credit cards risk theft or loss.

Biometric payment technology offers a seamless alternative. It eliminates the need to remember PINs or carry multiple cards. With just a fingerprint or facial recognition scan, transactions happen in an instant.

Moreover, biometric systems enhance security significantly. Unlike traditional methods that rely on something you know or possess, biometrics use unique physical traits that are much harder to replicate.

This shift could reshape our relationship with money altogether. As we embrace this advanced technology, the convenience factor makes it hard to overlook its growing presence in everyday life.

Future Possibilities and Potential Impact on Society

As biometric payment technology advances, the future holds exciting possibilities. Imagine a world where transactions are seamless and instantaneous. With just a glance or a fingerprint, purchases could be completed in seconds.

This convenience might lead to increased consumer spending. People may feel more inclined to buy on impulse when payments require minimal effort.

Moreover, the integration of biometrics into everyday life could reshape our approach to security and identity verification. It has the potential to reduce fraud significantly, instilling greater trust in online and offline transactions.

However, this shift raises questions about privacy and data ownership. How will personal information be safeguarded? The balance between efficiency and security will become increasingly critical as society adapts to these technological advancements.

In sectors like healthcare or finance, biometric payment systems can streamline operations while enhancing user experience. This evolution may redefine how industries interact with customers at all levels.

Conclusion

Biometric payment technology represents a significant shift in how we conduct transactions. The combination of convenience, efficiency, and enhanced security makes it an appealing option for consumers and businesses alike. As more industries adopt this innovative approach, the landscape of payment methods is evolving rapidly.

With its various applications spanning retail, banking, and even healthcare, biometric technology has the potential to redefine our interactions with money. While there are valid concerns about privacy and data security that need addressing, ongoing advancements aim to ensure that user information is safeguarded.

As society becomes increasingly reliant on digital solutions for everyday tasks, embracing biometric payments could pave the way for a future where financial transactions are seamless and secure. The journey ahead will undoubtedly be captivating as we explore new possibilities driven by this groundbreaking technology.